Why Investing in Land Is More Stable Than Gold or Stocks

If you’ve been contemplating your future—planning college funds for the kids, inspecting your investment portfolio, and keeping track of your retirement fund—chances are you’ve debated the wisdom of various investment options. The three most popular choices are precious metals, real estate, and stocks. Your question, obviously, is “Which one provides the most reliable return on investment?"

To make that decision, you must understand how each investment works and where your returns will come from. Let’s take a look.

Stocks and Bonds

Most inexperienced investors think immediately of the stock market when they’re ready to make their first investment. With stories like The Wolf of Wall Street and The Pursuit of Happyness on the big screens, it’s easy to believe everyone who pursues stocks and bonds will someday own a mansion and drive a Maserati. Before you get blinded by the hype, take note of a few things: First, the people getting rich in these stories were the brokers—not the investors. Second, the higher you rise, the farther you have to fall.

Stocks and bonds can be amazing investments, but they’re tied very tightly to the state of our national economy. When the country experiences financial unrest, stocks and bonds are often dumped quickly in favor of more tangible investments. For this reason, many rely on stocks and bonds for short-term gains only. Does that sound like something you need for your retirement years?

Precious Metals

Precious metals, specifically gold, also rely on the state of our national economy for their values, but these work in the exact opposite way stocks and bonds perform. When people are panicked and looking for something tangible to purchase instead of their stocks, many turn to gold and silver. For that reason, the values of precious metals often skyrocket when other investment options are plummeting.

As you might imagine, this means the values of precious metals then take a tumble when we’re experiencing a strong economy. Overall, precious metals values are still on the rise, especially if you consider the prices over the past thirty years. In the short term, they can be just as volatile as stocks and bonds. Can you be certain what the state of the economy will be when you’re ready to retire? Are you willing to wait until the nation is in a financial panic to sell your precious metals? If not, you need something even more stable than stocks or precious metals.

Investing in Land

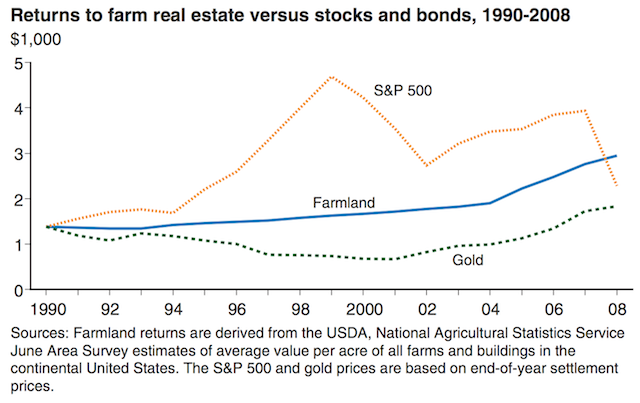

Only one of the available options for long-term investment can offer the stability you need and deserve. As you can see from the graph below, which was compiled by the USDA, only farmland has risen steadily in value, regardless of inflation, since 1990. While land investments are subject to dips due to the economic state of the country, you can see the drop isn’t as drastic and recovery takes less time than either precious metals or stocks.

So, now you have a pretty good idea of the most stable long-term investment available. What can you do about it? If you’re ready to add land to your retirement portfolio, we’re here to help. Talk to us about the properties we have available in Georgia, Tennessee, and South Carolina. All of our farms are near metro areas, including Nashville, Greenville, and Atlanta. This helps to increase the value of your land even more, because farmland near population centers is worth more than land located farther away.

With as little as $295 for your down payment, you can invest in something tangible, useful, and reliable. And when you’re ready to retire, increasing property values will provide the means for your laid-back Southern life.

An earlier version of this blog was posted on 8/8/14. It has been updated to include new information.